Key Insights for Solicitors

Testamentary Trust Wills

We hear from many solicitors that one of the most challenging part of estate‑planning conversations is helping clients understand the financial benefits behind structures like Testamentary Discretionary Trusts (TDTs).

You are sure to frequently face clients who question whether they “need” Wills which incorporate TDTs without appreciating how super balances, potential insurance proceeds, and future wealth accumulation will transform their estate profile, and unlock the real tax advantages of TDTs.

Our goal is to support you and your practice with a quick practical explanation and framework, which you can hopefully use directly with your clients.

When clients understand the genuine financial benefit, particularly the tax savings and asset‑protection advantages of Wills which incorporate TDTs, they are far more willing to invest in a well‑structured estate plan, ensuring both better outcomes for them and increased professional value for you and your firm.

Many clients self-assess their Estate Planning needs based solely on their present financial position.

What we often see is that clients tend to only consider their current assets such as:

bank accounts

home equity

current investments

It is common to often struggle overcoming this bias because clients have a “today only” mindset however, it is important to shift your clients mind frame to their future assets. Afterall, Estate Planning at it’s core is about being ‘future-proof'.

Consider reminding that their overall Estate can be pushed well past $1M+ when you consider:

superannuation balances

life insurance/s inside super

life insurance/s outside super

future wealth accumulation

Reframing Estate Planning From “Today” to “On the Day It Matters Most”

The (financial ) case for Wills which incorporate Testamentary Trusts

A Testamentary Discretionary Trust (TDT) Will has become one of the most effective tools for families who want tax efficiency, long‑term protection, and controlled distribution of their estate.

Here is the clear case for why we (as financial advisers) believe TDT Wills matter.

Significant Potential Tax Savings for Beneficiaries (Especially Beneficiary with Young Children)

The tax rules for family trusts can be tough on young beneficiaries. If you distribute income to a child under 18 from a family trust, or place investments into their name, the minor usually pays penalty tax rates, meaning anything over ~$416 a year can get taxed at up to 66%.

However, with TDTs, the trustee can distribute income to beneficiaries (including minors) at adult marginal tax rates, meaning around $22,000 can be received tax-free per minor. If there are multiple children, or grandchildren, the benefit can be multiplied.

Essentially, if the Estate proceeds are not needed for immediate capital needs, we see clients most likely wanting to utilise Estate proceeds to supplement their own income. This in turn leads the beneficiary to potentially invest the Estate proceeds.

Inevitably this leads to income being generated by the investment. With a TDT, the trustee can optimise distributions each year to beneficiaries, often utilising multiple (adult) tax-free thresholds, such as minor children.

Case Study: TDT vs. a Simple Will

Husband (David) passes away unexpectedly.

After having Super + Insurance paid to the Estate, there is a total Estate pool of $1,000,000 left to wife (Emma).

Emma has now returned to full-time work earning $75,000 p.a.

Emma also has three minor children:

Chloe (12)

Jack (9)

Mia (7)

Emma wants to invest the inheritance to produce income for family living expenses.

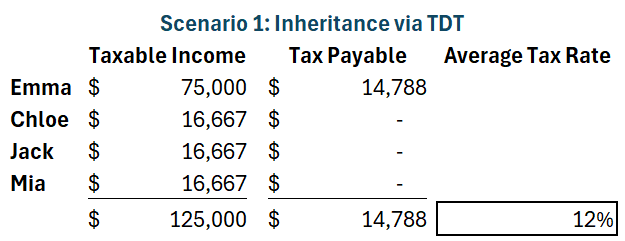

Scenario 1: Inheritance via TDT

David had a TDT Will and Emma, after receiving advice from the family’s solicitor, financial planner and accountant, decides to invest the $1,000,000 inside the TDT.

Investment return: 5% income = $50,000 per year.

The trustee (Emma) can allocate this income tax‑effectively across the children because beneficiaries of a TDT are treated as adults for tax purposes, even when they are minors.

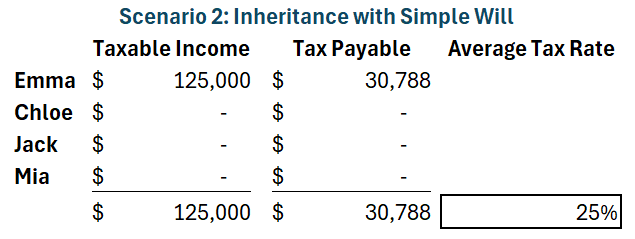

Scenario 2: Inheritance via Simple Will

David did not have a TDT Will. Emma decides to invest the $1,000,000 in her own name.

Investment return: 5% income = $50,000 per year.

This income is added to Emma’s taxable income, in addition to her employment income. The investment is not recommended to be in minors name/s as this will attract hefty tax rates (up to 66%).

By shifting the conversation from a client’s “today” assets to the estate their family will actually inherit on the day their will operates, you can help your clients appreciate why flexible structures like TDTs matter—especially when superannuation balances, life insurance payouts and future asset growth are factored in.

We are genuinely interested in being able to assist you and your firm.

Whether you’re looking to deepen your estate‑planning offering, strengthen client outcomes, or simply have a trusted financial planning partner in understanding the financial aspects of TDT implementation, we’re here to help.

If you’d like to explore how we can work together, we’d welcome a conversation.