Start now to give your children the best start

Everyone wants the best for their children. Providing a good education is a huge part of preparing them for the best possible future. But as education becomes more expensive, planning and budgeting for these costs becomes essential.

If you’re planning to send your children to a private school, you are probably already juggling a mortgage, ongoing household expenses and the day-to-day costs of raising children such as sports and other activities. It’s not easy to save extra while still maintaining the lifestyle that you enjoy.

Here are some steps to help you get on the right track to fund their education.

1. Start now

The sooner you start saving the better. Consider a regular investment plan to take advantage of compounding interest.

2. Make sure your insurances are adequate and up-to-date

Think about income protection, life insurance and cover for extended illness.

3. Pay as much as you can afford into your mortgage with an offset/ withdraw facility

This will help reduce the interest and then have the option to redraw to pay for school fees.

4. Work out how much you need to put aside

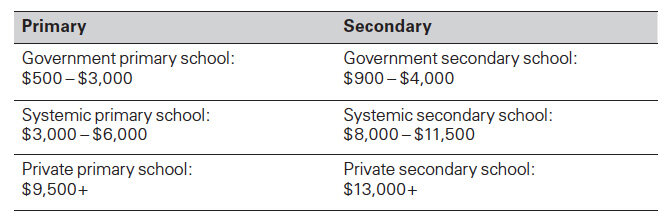

The table shows a rough guide to the costs of primary and secondary education. These figures represent the upper ranges that parents can reasonably expect to pay, although fees vary across states, ages and schools.

5. Make the most of gifting

For grandparents and those wanting to give something special, a savings account could be a great way to give a new baby something that will grow with them.

6. Pre-pay education expenses

If you already have children at school, check if the school allows you to prepay fees at a discounted rate. If you are able to pay upfront, it may help reduce the worry about rising costs into the future.

Take a moment to make sure you’re on the right track. Get in touch with us today about what you can do straight away to ensure your child’s education is the best it can be.